VANCOUVER, BC, Nov. 21, 2022 /CNW/ - Lundin Gold Inc. (TSX: LUG) (Nasdaq Stockholm: LUG) (OTCQX: LUGDF) ("Lundin Gold" or the "Company") is pleased to announce results from its conversion drilling program at its 100% owned Fruta del Norte gold mine in southeast Ecuador. The conversion drilling program, targeting Inferred Mineral Resources ("Inferred Resources") along the southern extension of the Fruta del Norte deposit, aims to extend the mine life by converting Inferred Resources. Results obtained have confirmed the wide, consistent nature of mineralization throughout the southern sector and have also generated new targets outside of the resource envelope for further work as part of the Company's near mine program. PDF Version

Ron Hochstein, President and CEO, commented, "I am pleased to announce these exciting drill results, which have confirmed the continuity of mineralization along the southern extension of our current Inferred Resources and will support the completion of a Mineral Reserve and Resource update and subsequent 43-101 report, anticipated to be released in the first quarter of 2023. Additionally, several of these results suggest that Fruta del Norte remains open at depth and underlines the significant potential for resource growth through the near mine exploration program."

CONVERSION DRILLING PROGRAM

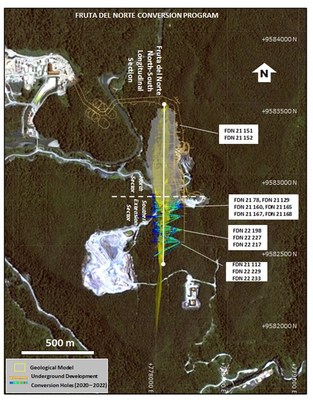

Since 2021, the Company has been advancing its conversion program at Fruta del Norte, with the objective of converting Inferred Resources to Measured or Indicated Resources. The Fruta del Norte deposit is currently estimated to contain a large Inferred Resource of approximately 11.6 million tonnes averaging 5.69 grams per tonne ("g/t") gold, containing 2,130,300 ounces of gold. A total of 18,340 metres of underground drilling across 88 drill holes has been completed, the results of which will improve confidence in and further support the geological model and assist the Company in preparing an update to the current Mineral Reserve and Resource estimate at Fruta del Norte.

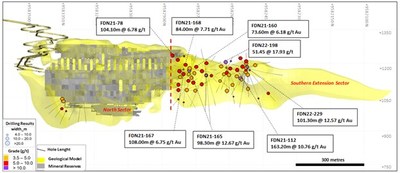

Numerous drill holes returned high grade intercepts associated with a hydrothermal alteration zone with veins, veinlets and minor breccias or stockwork zones hosted by a volcanic rock domain (see Table 1). These results confirm that the mineralized zone extends a further 300 metres past the current Fruta del Norte Mineral Reserve boundary, in the southern direction (see Figure 1). Some of the most notable results include the following drill intercepts (not true width):

- 12.57 g/t of gold over 101.30 metres (FDN22-229)

- 10.76 g/t of gold over 163.20 metres (FDN21-112)

- 12.67 g/t of gold over 98.30 metres (FDN21-165)

- 17.93 g/t of gold over 51.45 metres (FDN22-198)

Complete assay results for the entire conversion drilling program can be found in Tables 3 and 4 in the Appendix.

Results from the conversion program allow for better delineation of the distribution and controls of higher-grade mineralized zones within the known Inferred Resource and significantly enhance the southern extension in the current geological model. The Company is in the process of analyzing the full set of this data with the objective of preparing an updated estimate of Mineral Reserves and Resources for Fruta del Norte in accordance with National Instrument 43-101 ("NI 43-101") by the end of the first quarter of 2023. Based on the new geological model, further conversion drilling targets will be defined for 2023 and 2024.

Table 1: Highlights of Fruta del Norte conversion drilling for intervals greater than 3.5 g/t1 and minimum drilling length of 4 metres. All drill hole intercepts are reported in drilling lengths.

Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

FDN21-078 | 0.00 | 104.10 | 104.10 | 6.78 | 14.99 |

including | 57.00 | 65.60 | 8.60 | 47.43 | 47.12 |

FDN21-112 | 0.00 | 163.20 | 163.20 | 10.76 | 7.10 |

including | 26.90 | 55.50 | 28.60 | 49.83 | 22.16 |

FDN21-160 | 0.00 | 81.65 | 81.65 | 10.64 | 4.48 |

FDN21-160 | 85.65 | 159.25 | 73.60 | 6.18 | 5.38 |

including | 113.00 | 118.00 | 5.00 | 34.87 | 3.22 |

FDN21-165 | 74.55 | 172.85 | 98.30 | 12.67 | 5.55 |

including | 75.50 | 84.90 | 9.40 | 83.98 | 25.82 |

FDN21-167 | 77.00 | 185.00 | 108.00 | 6.75 | 5.33 |

including | 128.00 | 141.70 | 13.70 | 10.67 | 6.15 |

FDN21-168 | 0.00 | 84.00 | 84.00 | 7.71 | 7.47 |

including | 65.70 | 70.45 | 4.75 | 126.70 | 68.84 |

FDN22-198 | 62.40 | 113.85 | 51.45 | 17.93 | 10.69 |

including | 67.45 | 88.00 | 20.55 | 43.54 | 13.24 |

FDN22-229 | 0.00 | 101.30 | 101.30 | 12.57 | 8.31 |

including | 38.20 | 53.00 | 14.80 | 68.42 | 17.44 |

_______________________________ |

1 Mineral Resources are reported at a cut-off grade of 3.5 g/t Au; which was calculated using a long term gold price of US$1,500/oz. |

POTENTIAL AREAS FOR EXPANSION AT DEPTH AT FRUTA DEL NORTE

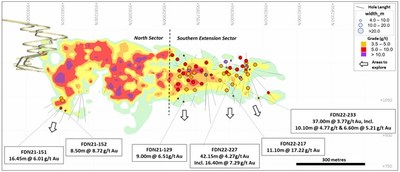

In addition to supporting the conversion of Inferred Resources, some conversion drilling results have also provided additional targets for our near mine exploration program. These drilling intercepts from the deepest boundary of the Fruta del Norte mineral resource envelope indicate that the deposit remains open at depth. The results have defined new potential areas for resource growth, below the defined mineral resource envelope in the north sector and along the southern extension (see Figure 2).

Most of the drilling results obtained are of a hydrothermal alteration similar to that occurring in Fruta del Norte's Mineral Reserves, where the mine is currently operating (see Table 2). In the northern part of the deposit, drill holes intercepted wide hydrothermal alteration zones represented by breccias, veining or stockwork zones, very similar in style and geometry to that found in the area currently being mined. In the southern extension, the Fruta del Norte deposit changes to a veining dominant style hosted in volcanic rocks, with drilling results suggesting potential for growth along the downdip continuity.

The near mine program currently has one underground rig turning, which is further investigating the continuity of the Fruta del Norte system at depth, in both the north and south sectors. In addition to the underground rig, the program includes two surface rigs testing the southerly extension of Fruta del Norte. To the end of October, 6,190 metres have been drilled on this program.

Table 2: Highlights from Fruta del Norte drilling at depth for intervals greater than 3.5 g/t1 and minimum drilling length of 4 metres. All drill hole intercepts are reported in drilling lengths.

Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

FDN21-129 | 160.60 | 169.60 | 9.00 | 6.51 | 1.78 |

FDN21-151 | 108.55 | 125.00 | 16.45 | 6.01 | 6.11 |

FDN21-152 | 132.50 | 141.00 | 8.50 | 8.72 | 16.72 |

FDN22-217 | 192.10 | 203.20 | 11.10 | 17.22 | 4.62 |

FDN22-227 | 137.85 | 180.00 | 42.15 | 4.27 | 1.78 |

including | 161.00 | 177.40 | 16.40 | 7.29 | 3.07 |

FDN22-233 | 132.45 | 169.45 | 37.00 | 3.77 | 1.46 |

including | 132.45 | 142.55 | 10.10 | 4.77 | 2.03 |

including | 162.85 | 169.45 | 6.60 | 5.21 | 1.36 |

Qualified Persons

The technical information contained in this News Release has been reviewed and approved by Andre Oliveira, P. Geo, Vice President, Exploration of the Company, who is a Qualified Person in accordance with the requirements of NI 43-101.

Samples consist of half HQ and NQ-size diamond core that are split by diamond saw on site, prepared at the ALS laboratory in Quito, and analysed by 50g fire assay and multi-element (ICP-AES/ICP-MS) at the ALS Laboratory in Lima, Peru. The quality assurance-quality control (QA-QC) program of Lundin Gold includes the insertion of certified standards of known gold content, blank and duplicate samples. The remaining half core is retained for verification and reference purposes. For further information on the assay, QAQC and data verification procedures, please see Lundin Gold's Annual Information Form dated March 21, 2022, filed under the Company's profile on SEDAR (www.sedar.com).

_____________________________ |

1 Mineral Resources are reported at a cut-off grade of 3.5 g/t Au; which was calculated using a long term gold price of US$1,500/oz. |

About Lundin Gold

Lundin Gold, headquartered in Vancouver, Canada, owns the Fruta del Norte gold mine in southeast Ecuador. Fruta del Norte is among the highest-grade operating gold mines in the world.

The Company's board and management team have extensive expertise in mine operations and are dedicated to operating Fruta del Norte responsibly. The Company operates with transparency and in accordance with international best practices. Lundin Gold is committed to delivering value to its shareholders, while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace and minimizing the environmental impact. The Company believes that the value created through the development of Fruta del Norte will benefit its shareholders, the Government and the citizens of Ecuador.

Additional Information

The information in this release is subject to the disclosure requirements of Lundin Gold under the EU Market Abuse Regulation. This information was publicly communicated on November 21, 2022 at 2:00 p.m. Pacific Time through the contact persons set out below.

Caution Regarding Forward-Looking Information and Statements

Certain of the information and statements in this press release are considered "forward-looking information" or "forward-looking statements" as those terms are defined under Canadian securities laws (collectively referred to as "forward-looking statements"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as "believes", "anticipates", "expects", "is expected", "scheduled", "estimates", "pending", "intends", "plans", "forecasts", "targets", or "hopes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "will", "should" "might", "will be taken", or "occur" and similar expressions) are not statements of historical fact and may be forward-looking statements. By their nature, forward-looking statements and information involve assumptions, inherent risks and uncertainties, many of which are difficult to predict, and are usually beyond the control of management, that could cause actual results to be materially different from those expressed by these forward-looking statements and information. Lundin Gold believes that the expectations reflected in this forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking information should not be unduly relied upon. This information speaks only as of the date of this press release, and the Company will not necessarily update this information, unless required to do so by securities laws.

This press release contains forward-looking information in a number of places, such as in statements relating to the Company's exploration activities and results, such as efforts to expand Mineral Resources estimates, upgrade Inferred Resources to other higher categories of Mineral Resources and to prepare an update to estimates of Mineral Resources and Reserves at Fruta del Norte. There can be no assurance that such statements will prove to be accurate, as Lundin Gold's actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in the "Risk Factors" section in Lundin Gold's Annual Information Form dated March 21, 2022, which is available at www.lundingold.com or on SEDAR.

Lundin Gold's actual results could differ materially from those anticipated. Factors that could cause actual results to differ materially from any forward-looking statement or that could have a material impact on the Company or the trading price of its shares include: risks associated with the Company's community relationships; risks related to political and economic instability in Ecuador; risks related to estimates of production, cash flows and costs; the impacts of a pandemic virus outbreak; risks inherent to mining operations; failure of the Company to maintain its obligations under its debt facilities; shortages of critical supplies; control of the Company's largest shareholders; risks related to Lundin Gold's compliance with environmental laws and liability for environmental contamination; the lack of availability of infrastructure; the Company's reliance on one mine; exploration and development risks; risks related to the Company's ability to obtain, maintain or renew regulatory approvals, permits and licenses; uncertainty with the tax regime in Ecuador; risks related to the Company's workforce and its labour relations; volatility in the price of gold; the reliance of the Company on its information systems and the risk of cyber-attacks on those systems; deficient or vulnerable title to concessions, easements and surface rights; inherent safety hazards and risk to the health and safety of the Company's employees and contractors; the imprecision of Mineral Reserve and Resource estimates; key talent recruitment and retention of key personnel; volatility in the market price of the Company's shares; measures to protect endangered species and critical habitats; social media and reputation; the cost of non-compliance and compliance costs; risks related to illegal mining; the adequacy of the Company's insurance; risks relating to the declaration of dividends; uncertainty as to reclamation and decommissioning; the ability of Lundin Gold to ensure compliance with anti-bribery and anti-corruption laws; the uncertainty regarding risks posed by climate change; limits of disclosure and internal controls; security risks to the Company, its assets and its personnel; the potential for litigation; and risks due to conflicts of interest.

APPENDIX

Figure 3: Map of the conversion drilling program

Table 3: Drillhole assay results from Fruta del Norte conversion drilling program reported for intervals above 3.5 g/t and minimum drilling length of 4 metres.

Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

FDN20-067 | Not Significant results | ||||

FDN21-077 | 69.60 | 152.80 | 83.20 | 5.73 | 6.50 |

FDN21-078 | 0.00 | 104.10 | 104.10 | 6.78 | 14.99 |

FDN21-079 | 104.40 | 181.50 | 77.10 | 5.01 | 6.03 |

FDN21-092 | Not Significant results | ||||

FDN21-095 | 82.50 | 148.00 | 65.50 | 5.35 | 5.31 |

FDN21-097 | 138.30 | 179.00 | 40.70 | 3.84 | 2.67 |

FDN21-098 | 89.60 | 155.10 | 65.50 | 4.07 | 2.50 |

FDN21-100 | 93.50 | 137.70 | 44.20 | 5.76 | 9.70 |

FDN21-102 | Not Significant results | ||||

FDN21-104 | Not Significant results | ||||

FDN21-105 | 72.75 | 90.65 | 17.90 | 18.51 | 9.45 |

138.00 | 186.40 | 48.40 | 4.53 | 2.12 | |

FDN21-109 | Not Significant results | ||||

FDN21-111 | 0.00 | 43.70 | 43.70 | 5.83 | 7.82 |

FDN21-112 | 0.00 | 163.20 | 163.20 | 10.76 | 7.10 |

FDN21-114 | 21.50 | 106.50 | 85.00 | 4.23 | 6.50 |

FDN21-116 | 17.00 | 100.00 | 83.00 | 3.49 | 5.23 |

FDN21-117 | Not Significant results | ||||

FDN21-119 | 0.00 | 10.00 | 10.00 | 25.27 | 16.09 |

FDN21-121 | 0.00 | 11.40 | 11.40 | 10.44 | 8.92 |

189.20 | 196.80 | 7.60 | 5.10 | 0.77 | |

FDN21-123 | Not Assays | ||||

FDN21-125 | 0.00 | 9.20 | 9.20 | 11.38 | 8.31 |

192.00 | 202.85 | 10.85 | 8.21 | 1.68 | |

FDN21-127 | Not Significant results | ||||

FDN21-129 | 160.60 | 169.60 | 9.00 | 6.51 | 1.78 |

FDN21-130 | 116.20 | 158.70 | 42.50 | 6.86 | 3.00 |

FDN21-132 | Not Significant results | ||||

FDN21-134 | 104.40 | 161.00 | 56.60 | 4.08 | 2.20 |

FDN21-136 | 134.55 | 168.40 | 33.85 | 6.22 | 2.06 |

FDN21-138 | 108.45 | 173.10 | 64.65 | 8.54 | 3.67 |

FDN21-140 | 128.75 | 170.70 | 41.95 | 3.86 | 1.44 |

FDN21-142 | 115.40 | 168.70 | 53.30 | 5.65 | 3.25 |

FDN21-144 | 151.30 | 160.20 | 8.90 | 6.19 | 2.96 |

FDN21-147 | 0.00 | 99.45 | 99.45 | 4.56 | 4.87 |

FDN21-149 | 0.00 | 105.20 | 105.20 | 4.34 | 5.64 |

Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

FDN21-151 | 108.55 | 125.00 | 16.45 | 6.01 | 6.11 |

FDN21-152 | 132.50 | 141.00 | 8.50 | 8.72 | 16.72 |

FDN21-154 | Not Significant results | ||||

FDN21-156 | Not Significant results | ||||

FDN21-158 | Not Significant results | ||||

FDN21-160 | 0.00 | 81.65 | 81.65 | 10.64 | 4.48 |

85.65 | 159.25 | 73.60 | 6.18 | 5.38 | |

FDN21-162 | 90.00 | 166.65 | 76.65 | 4.18 | 2.69 |

FDN21-164 | Not Significant results | ||||

FDN21-165 | 74.55 | 172.85 | 98.30 | 12.67 | 5.55 |

FDN21-166 | 69.25 | 176.00 | 106.75 | 4.47 | 2.38 |

FDN21-167 | 77.00 | 185.00 | 108.00 | 6.75 | 5.33 |

FDN21-168 | 0.00 | 84.00 | 84.00 | 7.71 | 7.47 |

156.35 | 170.40 | 14.05 | 5.05 | 3.61 | |

FDN21-169 | 91.10 | 174.85 | 83.75 | 6.59 | 2.56 |

FDN21-170 | 88.70 | 173.00 | 84.30 | 4.93 | 3.18 |

FDN21-171 | 68.00 | 167.00 | 99.00 | 4.51 | 4.98 |

FDN21-172 | 64.60 | 194.00 | 129.40 | 5.92 | 4.59 |

FDN21-173 | 78.20 | 197.00 | 118.80 | 4.40 | 4.76 |

FDN21-174 | 167.45 | 176.50 | 9.05 | 3.94 | 3.87 |

FDN22-175 | Not Significant results | ||||

FDN22-176 | Not Significant results | ||||

FDN22-178 | 175.00 | 180.50 | 5.50 | 5.83 | 5.06 |

FDN22-180 | Not Significant results | ||||

FDN22-182 | Not Significant results | ||||

FDN22-184 | Not Significant results | ||||

FDN22-186 | Not Significant results | ||||

FDN22-189 | Not Significant results | ||||

FDN22-191 | Not Significant results | ||||

FDN22-194 | Not Significant results | ||||

FDN22-196 | 95.30 | 147.00 | 51.70 | 5.94 | 3.26 |

FDN22-198 | 62.40 | 113.85 | 51.45 | 17.93 | 10.69 |

FDN22-199 | Not Significant results | ||||

FDN22-201 | 65.00 | 107.75 | 42.75 | 4.51 | 7.90 |

FDN22-203 | Not Significant results | ||||

FDN22-205 | Not Significant results | ||||

FDN22-207 | 0.00 | 101.00 | 101.00 | 6.80 | 6.18 |

FDN22-209 | Not Significant results | ||||

FDN22-211 | 93.25 | 104.00 | 10.75 | 33.61 | 17.87 |

FDN22-213 | 91.40 | 152.55 | 61.15 | 4.65 | 3.98 |

Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

FDN22-215 | 99.00 | 148.60 | 49.60 | 8.78 | 3.76 |

FDN22-217 | 192.10 | 203.20 | 11.10 | 17.22 | 4.62 |

FDN22-219 | Not Significant results | ||||

FDN22-221 | 117.90 | 165.65 | 47.75 | 3.64 | 1.93 |

FDN22-222 | Not Significant results | ||||

FDN22-225 | Not Significant results | ||||

FDN22-227 | 137.85 | 180.00 | 42.15 | 4.27 | 1.78 |

FDN22-228 | 63.00 | 99.80 | 36.80 | 3.94 | 9.61 |

FDN22-229 | 0.00 | 101.30 | 101.30 | 12.57 | 8.31 |

FDN22-230 | 0.00 | 25.40 | 25.40 | 7.86 | 6.94 |

FDN22-231 | 14.70 | 141.20 | 126.50 | 6.39 | 5.81 |

FDN22-232 | 0.00 | 24.00 | 24.00 | 3.70 | 3.90 |

FDN22-233 | 0.00 | 15.00 | 15.00 | 5.52 | 5.03 |

132.45 | 169.45 | 37.00 | 3.77 | 1.46 | |

FDN22-234 | 119.60 | 139.70 | 20.10 | 3.72 | 0.98 |

FDN22-235 | 0.00 | 20.00 | 20.00 | 7.57 | 4.18 |

FDN22-236 | 80.00 | 111.60 | 31.60 | 8.43 | 4.74 |

Table 4: Collar locations of reported drill holes

Hole ID | Prospect | Easting | Northing | Elevation | Azimuth | Dip | EOH (m) |

FDN20-067 | Conversion | 778166.37 | 9582835.39 | 1198.01 | 239.65 | 6.26 | 203.20 |

FDN21-077 | Conversion | 778166.38 | 9582835.94 | 1197.98 | 262.15 | 16.31 | 183.20 |

FDN21-078 | Conversion | 778166.12 | 9582835.69 | 1198.91 | 261.85 | -15.68 | 139.40 |

FDN21-079 | Conversion | 778166.61 | 9582836.01 | 1198.78 | 277.08 | -14.59 | 208.00 |

FDN21-092 | Conversion | 778176.14 | 9582705.08 | 1176.20 | 255.26 | 1.95 | 201.10 |

FDN21-095 | Conversion | 778175.97 | 9582705.12 | 1175.64 | 254.99 | 16.94 | 203.70 |

FDN21-097 | Conversion | 778176.15 | 9582704.35 | 1175.35 | 243.28 | 21.04 | 251.50 |

FDN21-098 | Conversion | 778176.12 | 9582705.50 | 1175.66 | 268.28 | 17.11 | 249.50 |

FDN21-100 | Conversion | 778176.13 | 9582705.58 | 1176.76 | 268.01 | -11.10 | 209.80 |

FDN21-102 | Conversion | 778176.27 | 9582704.69 | 1177.20 | 255.10 | -17.95 | 174.60 |

FDN21-104 | Conversion | 778176.30 | 9582704.27 | 1176.87 | 243.09 | -11.06 | 156.70 |

FDN21-105 | Conversion | 778177.55 | 9582705.27 | 1175.40 | 268.12 | 27.97 | 352.70 |

FDN21-109 | Conversion | 778173.66 | 9582525.53 | 1179.79 | 294.32 | 10.10 | 207.70 |

FDN21-111 | Conversion | 778173.64 | 9582525.21 | 1180.48 | 290.21 | -6.02 | 183.40 |

FDN21-112 | Conversion | 778173.62 | 9582525.29 | 1179.26 | 290.12 | 29.98 | 231.30 |

FDN21-114 | Conversion | 778173.59 | 9582524.26 | 1180.65 | 270.08 | -8.94 | 177.10 |

FDN21-116 | Conversion | 778173.57 | 9582523.98 | 1179.92 | 270.14 | 8.75 | 192.20 |

FDN21-117 | Conversion | 778173.62 | 9582522.79 | 1181.62 | 242.30 | -7.19 | 225.00 |

FDN21-119 | Conversion | 778173.75 | 9582522.99 | 1179.72 | 245.20 | 14.99 | 213.20 |

FDN21-121 | Conversion | 778173.96 | 9582523.12 | 1179.00 | 245.15 | 45.05 | 245.80 |

FDN21-123 | Conversion | 778173.94 | 9582522.12 | 1179.81 | 229.32 | 10.19 | 266.90 |

FDN21-125 | Conversion | 778174.35 | 9582522.49 | 1179.08 | 229.30 | 37.93 | 253.70 |

FDN21-127 | Conversion | 778172.46 | 9582798.09 | 1082.47 | 268.88 | -16.13 | 192.00 |

FDN21-129 | Conversion | 778172.70 | 9582798.17 | 1081.27 | 271.19 | 19.85 | 204.10 |

FDN21-130 | Conversion | 778172.49 | 9582797.39 | 1082.45 | 254.03 | -14.85 | 210.10 |

FDN21-132 | Conversion | 778173.69 | 9582797.77 | 1081.40 | 254.29 | 22.05 | 200.70 |

FDN21-134 | Conversion | 778172.64 | 9582797.34 | 1081.71 | 265.17 | -1.15 | 186.10 |

FDN21-136 | Conversion | 778172.63 | 9582796.58 | 1082.23 | 242.13 | -9.90 | 210.10 |

FDN21-138 | Conversion | 778172.37 | 9582798.42 | 1082.25 | 282.23 | -10.96 | 193.20 |

FDN21-140 | Conversion | 778172.62 | 9582796.99 | 1081.68 | 250.42 | -0.99 | 191.50 |

FDN21-142 | Conversion | 778172.48 | 9582798.35 | 1081.74 | 279.00 | -0.17 | 221.10 |

FDN21-144 | Conversion | 778172.49 | 9582798.02 | 1081.39 | 280.32 | 15.23 | 263.60 |

FDN21-147 | Conversion | 778136.69 | 9583287.10 | 1077.05 | 320.42 | 25.05 | 188.80 |

FDN21-149 | Conversion | 778136.62 | 9583286.96 | 1076.88 | 315.05 | 31.85 | 191.60 |

FDN21-151 | Conversion | 778136.64 | 9583286.58 | 1076.97 | 300.93 | 34.02 | 209.20 |

Hole ID | Prospect | Easting | Northing | Elevation | Azimuth | Dip | EOH (m) |

FDN21-152 | Conversion | 778136.51 | 9583286.89 | 1076.49 | 291.71 | 39.59 | 224.60 |

FDN21-154 | Conversion | 778147.00 | 9583254.61 | 1075.52 | 291.88 | 39.82 | 200.80 |

FDN21-156 | Conversion | 778147.00 | 9583254.66 | 1075.52 | 275.62 | 40.02 | 212.10 |

FDN21-158 | Conversion | 778147.36 | 9583254.07 | 1075.91 | 263.35 | 37.18 | 230.70 |

FDN21-160 | Conversion | 778185.56 | 9582769.79 | 1174.65 | 260.22 | -4.20 | 222.10 |

FDN21-162 | Conversion | 778185.58 | 9582769.95 | 1174.20 | 263.29 | 8.14 | 206.20 |

FDN21-164 | Conversion | 778185.63 | 9582770.21 | 1175.06 | 268.39 | -13.02 | 219.90 |

FDN21-165 | Conversion | 778185.48 | 9582770.42 | 1174.43 | 272.11 | 2.02 | 202.00 |

FDN21-166 | Conversion | 778185.48 | 9582770.42 | 1174.13 | 270.25 | 15.33 | 215.60 |

FDN21-167 | Conversion | 778185.34 | 9582770.88 | 1174.22 | 279.77 | 7.76 | 200.70 |

FDN21-168 | Conversion | 778185.34 | 9582770.81 | 1174.80 | 278.16 | -6.03 | 215.00 |

FDN21-169 | Conversion | 778185.48 | 9582769.83 | 1174.44 | 247.17 | 3.17 | 213.20 |

FDN21-170 | Conversion | 778185.41 | 9582770.49 | 1174.74 | 271.07 | -4.11 | 201.70 |

FDN21-171 | Conversion | 778185.40 | 9582770.49 | 1174.17 | 273.30 | 10.21 | 198.20 |

FDN21-172 | Conversion | 778185.33 | 9582770.66 | 1173.75 | 274.09 | 22.23 | 203.70 |

FDN21-173 | Conversion | 778185.83 | 9582771.26 | 1174.06 | 286.92 | 13.13 | 212.40 |

FDN21-174 | Conversion | 778185.32 | 9582770.90 | 1174.45 | 281.87 | -0.15 | 211.80 |

FDN22-175 | Conversion | 778185.41 | 9582771.39 | 1174.63 | 289.30 | -3.84 | 221.80 |

FDN22-176 | Conversion | 778185.43 | 9582771.29 | 1175.13 | 287.27 | -12.87 | 212.40 |

FDN22-178 | Conversion | 778186.49 | 9582770.77 | 1175.25 | 278.28 | -18.10 | 220.20 |

FDN22-180 | Conversion | 778185.54 | 9582770.18 | 1175.44 | 262.28 | -19.10 | 208.20 |

FDN22-182 | Conversion | 778176.19 | 9582706.90 | 1174.74 | 289.98 | 40.38 | 251.60 |

FDN22-184 | Conversion | 778176.70 | 9582705.90 | 1174.68 | 269.34 | 47.98 | 251.00 |

FDN22-186 | Conversion | 778177.28 | 9582705.67 | 1174.73 | 259.70 | 57.02 | 285.80 |

FDN22-189 | Conversion | 778176.52 | 9582705.22 | 1174.93 | 255.02 | 40.17 | 251.50 |

FDN22-191 | Conversion | 778176.28 | 9582706.27 | 1178.09 | 277.00 | -30.76 | 170.00 |

FDN22-194 | Conversion | 778178.69 | 9582608.32 | 1178.65 | 270.02 | -0.07 | 201.00 |

FDN22-196 | Conversion | 778178.60 | 9582608.36 | 1178.16 | 270.05 | 9.89 | 204.20 |

FDN22-198 | Conversion | 778178.52 | 9582608.74 | 1179.44 | 273.96 | -14.95 | 133.80 |

FDN22-199 | Conversion | 778178.62 | 9582608.19 | 1177.52 | 273.05 | 21.74 | 194.40 |

FDN22-201 | Conversion | 778178.52 | 9582608.93 | 1178.52 | 281.20 | -3.99 | 201.00 |

FDN22-203 | Conversion | 778178.49 | 9582608.95 | 1178.18 | 283.20 | 7.14 | 207.00 |

FDN22-205 | Conversion | 778178.51 | 9582609.04 | 1177.59 | 284.93 | 29.95 | 210.10 |

FDN22-207 | Conversion | 778178.59 | 9582608.03 | 1178.35 | 260.28 | -0.13 | 200.60 |

FDN22-209 | Conversion | 778178.63 | 9582608.04 | 1177.80 | 260.03 | 20.02 | 201.00 |

FDN22-211 | Conversion | 778178.65 | 9582608.14 | 1179.34 | 260.19 | -20.09 | 151.90 |

FDN22-213 | Conversion | 778178.57 | 9582607.74 | 1178.01 | 252.53 | 12.86 | 201.10 |

Hole ID | Prospect | Easting | Northing | Elevation | Azimuth | Dip | EOH (m) |

FDN22-215 | Conversion | 778178.56 | 9582607.53 | 1178.25 | 249.83 | 4.16 | 206.10 |

FDN22-217 | Conversion | 778178.56 | 9582607.35 | 1177.64 | 259.88 | 39.02 | 243.60 |

FDN22-219 | Conversion | 778178.56 | 9582608.67 | 1177.72 | 277.03 | 27.89 | 206.20 |

FDN22-221 | Conversion | 778178.53 | 9582607.95 | 1177.63 | 259.81 | 28.00 | 206.00 |

FDN22-222 | Conversion | 778178.47 | 9582608.69 | 1177.86 | 279.18 | 15.14 | 198.10 |

FDN22-225 | Conversion | 778179.07 | 9582608.04 | 1177.55 | 266.95 | 27.00 | 224.55 |

FDN22-227 | Conversion | 778179.04 | 9582608.75 | 1177.89 | 268.94 | 34.07 | 207.80 |

FDN22-228 | Conversion | 778178.62 | 9582608.08 | 1177.54 | 267.01 | 17.02 | 195.20 |

FDN22-229 | Conversion | 778173.71 | 9582524.16 | 1180.01 | 270.07 | -0.82 | 204.55 |

FDN22-230 | Conversion | 778173.78 | 9582524.27 | 1181.67 | 270.31 | -29.93 | 134.15 |

FDN22-231 | Conversion | 778173.71 | 9582523.94 | 1179.34 | 265.43 | 20.10 | 182.70 |

FDN22-232 | Conversion | 778173.72 | 9582524.69 | 1178.55 | 280.04 | 47.03 | 236.50 |

FDN22-233 | Conversion | 778173.80 | 9582523.83 | 1178.79 | 265.27 | 38.10 | 205.45 |

FDN22-234 | Conversion | 778173.71 | 9582524.63 | 1179.24 | 279.89 | 21.91 | 196.20 |

FDN22-235 | Conversion | 778173.70 | 9582524.53 | 1178.91 | 275.03 | 33.18 | 188.35 |

FDN22-236 | Conversion | 778173.58 | 9582525.07 | 1181.15 | 285.01 | -24.01 | 144.70 |

SOURCE Lundin Gold Inc.